QUICK & EASY

You can manage fund by yourself via Online 24/7 to check the statement / online payment / transfer money to other people,

as well as set the standing order or Direct Debit. You can use it as an account to make the tax system for Accountant Receive money from customers - Dealer as well as accepting payments in the Payment Gateway system from various card companies that you have. Business accounts has designed to receive your day-day clients fund payment. You can use account for business expenses i.e. Staff wages, Utility Bill or pay bill. You can control the exchange rate yourself from the financial market (Live Market) to switch money between various currency i.e. Converting from GBP to USD and transferring money out to other countries by yourself 24/7.FOREX / EXCHANGE

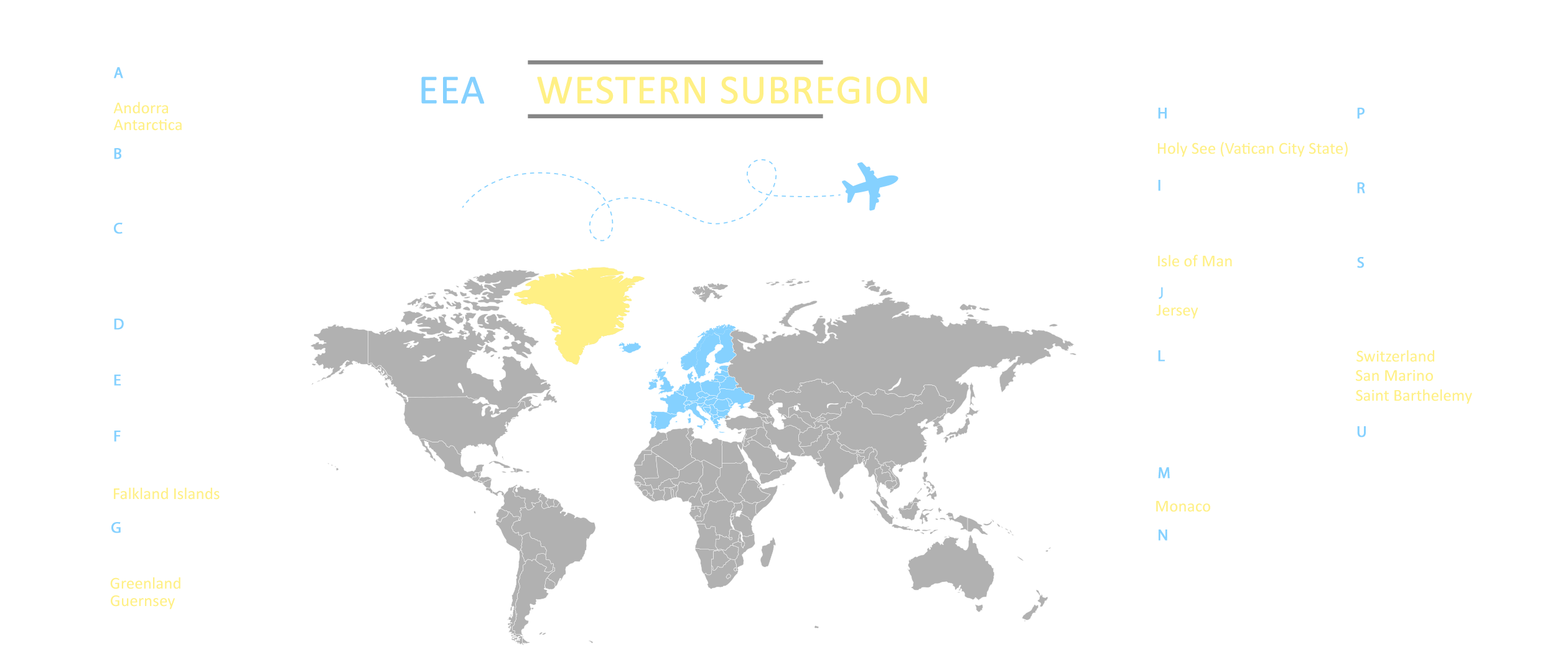

A&B Plus Business is designed to be connected to the mid-market rate system, where the exchange rate will change every minutes according to the forex market conditions. It’s suitable for the Money service business such as Currency exchange, Foreign money transfer business etc.

You can buy or sell various currencies from our online system 24 hours or contact our staff to negotiate a special exchange rate for a large volume at +44 (0) 203 355 9660

Safe & Secured

The money in your account will be protected in the security system from our top priority system and every payment order from our system. Order will be forwarded to our partner automated program system to send to the recipient's destination safely.

Open account with us, no matter what your business is, ... we are ready to turn your dream business into reality.

You can open business account with us if your company are resident in within the UK. +Terms and conditions

Opening account with us in GBP & EUR secured account system power by A&B Money Plus Business

+Partner with us

Become partner with us in worldwide financial sector and have authorised from regulators