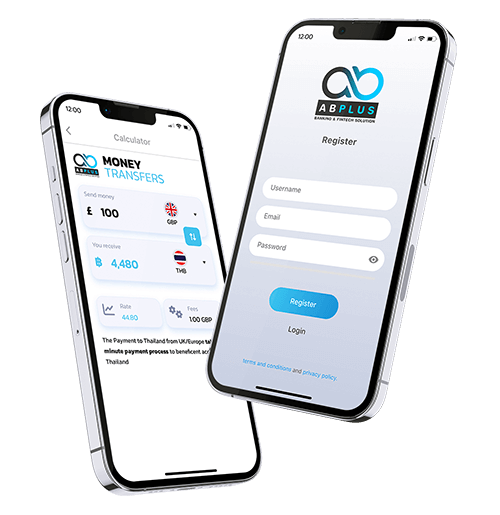

ACTIVATE CARD

After you make an order and make a payment, you will receive Card via post to the provided address in your order. When you receive the card, you have to activate card by pressing “Activate” bottom follow by filling 16 digits detail. You will receive 4 digits pin via SMS text message which you can use for cash machine (ATM) or spending at shop. The card cannot use if it has not been activated. For any further questions please contact our team at +44 (0) 203 355 9660 or +49 (0) 800 724 3923 on Monday-Saturday at 9.30-17.00

BLOCKCARD

In case of lost or stolen card, you can report this and request the replacement your card by phone at +44 (0) 203 355 9660 (UK) or +49 (0) 800 724 3923 (Germany). We can cancel our old card and we will send you the replacement card to the registered address. To make sure your fund is 100% secured and safe, all balance fund in the old card will be automatically transferred to new card

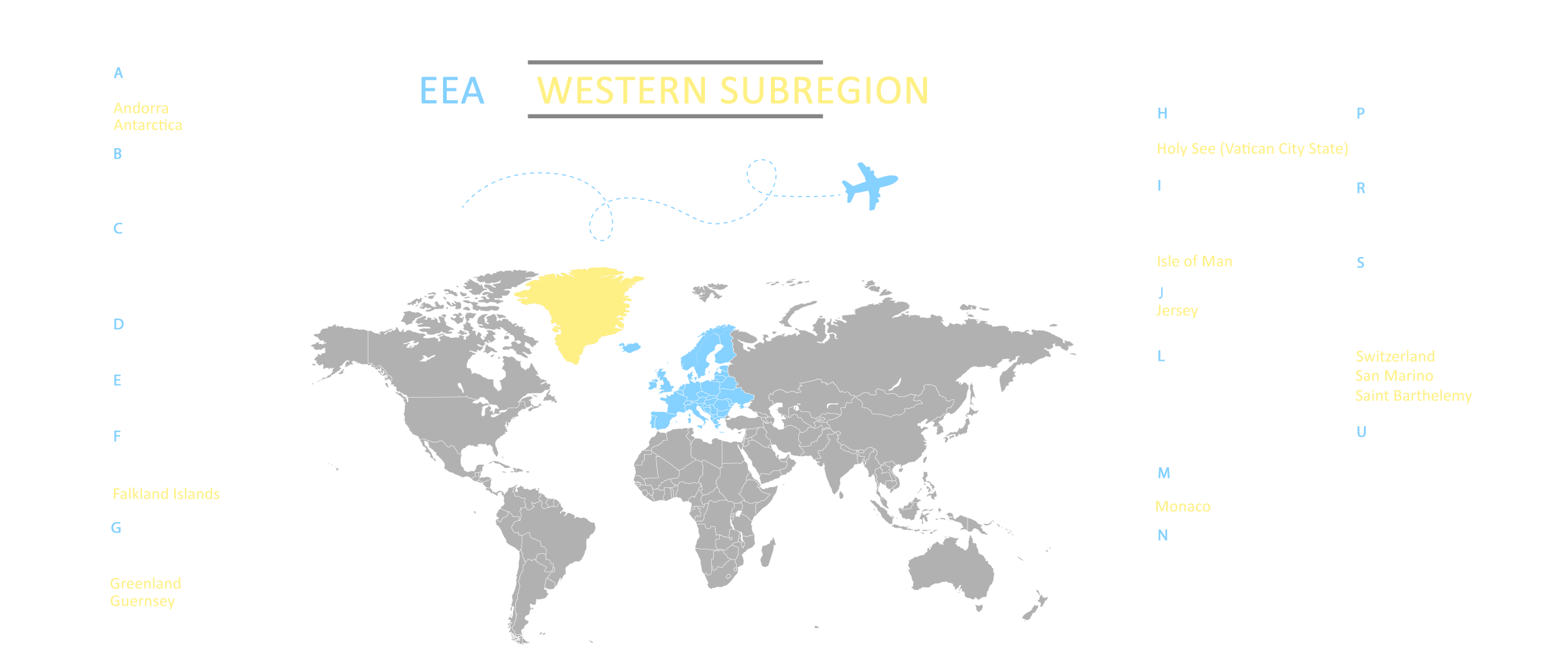

Only with passport and proof of address in UK (EEA is coming soon) you can unconditionally open account with us. However, for visitor visa person cannot apply with this account.

Opening account doesn’t check your credit score record. This will benefit all student visas who always have problems and limited conditions with opening account with bank.

+Support Team

Activate & Block your card in the case of lost or stolen via online account or team support

+Partner with us

Become partner with us in worldwide financial sector and have authorised from regulators