A&B MONEY PLUS

ข้อตกลงสำหรับบัญชีที่มีบัตรเดบิต

A&B Money Plus Prepaid Mastercard®

Terms and Conditions

Valid as of 05-Nov 2020

IMPORTANT INFORMATION: These terms and conditions (“Agreement”) govern the use of the Payment Services defined in Clause 1, which are supplied by A&B General (UK) Limited 10 Greenwich Quay Clarence Road London SE8 3EY whose details are in Clause 2 (“we”, “us”, “our”) to any person whose application we approve (“Customer”, “you”, “your”). Words that begin with a capital letter have the meaning given either where they first appear in this Agreement.

By activating your Card, you agree that you have read and understood the terms of this Agreement (a copy of which you may download and store at any time). This Agreement shall commence at that time and continue unless cancelled under Clause 10 or terminated under Clause 12. We reserve the right to change this Agreement by giving 2 months’ notice to you in accordance with Clause 18. If we do this, you may terminate this Agreement immediately and without charge before the proposed changes take effect, otherwise you shall be deemed to have accepted such changes when the 2 months’ notice expires. However, you agree that changes to the Applicable Exchange Rate may be applied immediately and at the rate quoted via the Payment Service at the time of the relevant Transaction. Please also read the conditions of redemption, including any fees relating to redemption, in Clause 11 before activating your Card.

We will communicate with you in English (the language in which this Agreement was agreed with you on registration for your Account). Key information relating to your Transactions will be provided to you at the email address you register with us and/or in your Account. You may access, download and print this information at any time by logging in to your Account. In addition, you agree that we may provide notices or other information to you from time to time by posting it in your Account, emailing it to your registered email address, mailing it to your registered physical address, calling you by phone or sending you mobile messages. Notices to you by email or mobile messages shall be deemed given 24 hours after the email is sent, unless the sending party is notified that the email address is invalid. Notices sent by registered mail shall be deemed to have been received three days after the date of mailing. You may contact us as specified in Clause 2.

You may request a copy of any legally required disclosures (including this Agreement) from us via the contact details in Clause 2, and we will provide this to you in a form which enables you to store the information in a way that is accessible for future reference for a period of time adequate for the purposes of the information and which allows the unchanged reproduction of the information stored via, for example, our website, your Account or by email.

- Definitions & Interpretation

In this document, if we use words that start with a capital letter, that means the word has been defined in this ‘Definition & Interpretation’ section.

"Account"

or “E-Wallet” a data account in our systems where we record your Available Balance, Transaction Data and other information from time to time;

“Account Closure 30 days notice from customers for request account closure. The monthly fee has the meaning given in the attached Fees & Limits Schedule;

“Account Information

Service”

means an online service to provide consolidated information on one or more payment accounts held by the payment service user with another payment service provider or with more than one payment service provider;

Account Information the supplier of an Account Information Service’;

Service Provider” or

“AISP”

"Additional where applicable, a person who holds a Secondary Card must be same

Cardholder" person on the First main card;

“ATM” An automated teller machine is an electronic telecommunications device that enables Customers to perform financial transactions, particularly cash withdrawal, without the need for a human cashier, clerk or bank teller;

“Authorised means any person to whom you authorise us to access your Account;

Person”

"Available Balance" the amount of E-money issued by us to you but not yet spent or redeemed;

“Business Day" Monday to Friday, 0900hrs to 1700hrs GMT, excluding bank and public holidays in the UK;

"Card" a prepaid Mastercard debit card issued by us and linked to your Account, which can be used to spend your Available Balance wherever Mastercard cards are accepted;

“Card Replacement has the meaning given in the attached Fees & Limits Schedule;

Fee”

"Card the operator of the payment scheme under which we issue each Card;

Scheme"

“Customer Due

Diligence” the process we are required to go through to verify the identity of our Customers;

“Customer Funds

Account” the segregated bank account where we hold relevant funds corresponding to your Available Balance in accordance with the safeguarding provisions of the Electronic Money Regulations 2011;

“Direct Debit” an automated payment method set up between you and us to send payments to organisations in accordance with a direct debit mandate given by you to the organisation which manages the frequency and amount of each payment;

“E-money” monetary value issued by us to your Account on receipt of funds on your behalf in our Customer Funds Account, equal to the amount of funds received;

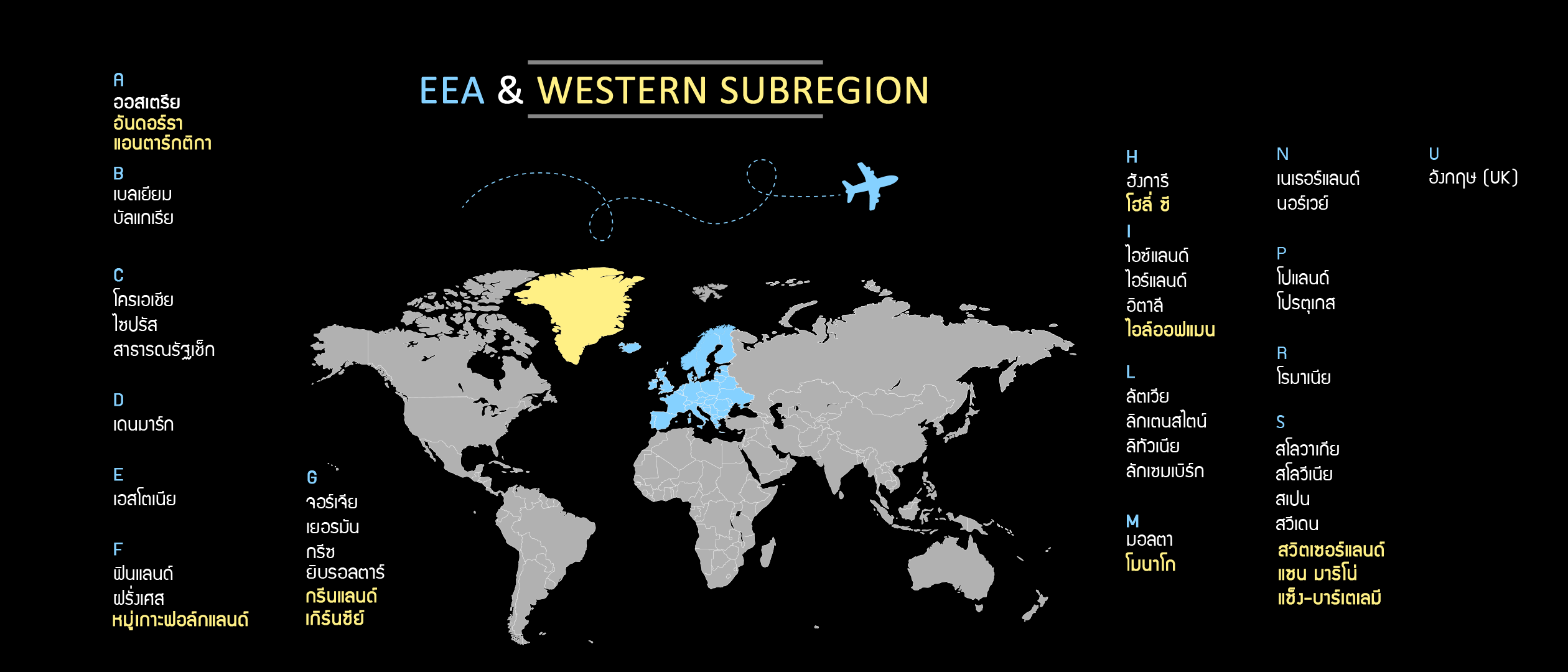

“European Economic

Area” or “EEA” The means the European Union (“EU”) member states, as well as Iceland, Liechtenstein and Norway.

“Fees” the fees payable by you for the Payment Services as specified in the attached Fees & Limits Schedule;

“IBAN” means an International Bank Account Number used to identify bank accounts for the purposes of international payments;

“Late Redemption

Fee” has the meaning given in the attached Fees & Limits Schedule;

"Merchant" a retailer who accepts Payment for the sale of goods or services to you.

“Payment” means a payment for goods or services using a Card.

“Payment Initiation

Service” means an online service to initiate a payment order at the request of the payment service user with respect to a payment account held at another payment service provider;

“Payment Initiation

Service Provider”

or (“PISP”) is a payment service provider who supplies a Payment Initiation Service;

"Payment Services" means the services supplied by us to you under this Agreement, including issuing Cards, Accounts and IBANs; and executing Transactions;

“A&B Plus IBAN” means a virtual IBAN issued by our bank service provider that we allocate to your Card or your Account which can be used by you or others for Direct Debits or for the purpose of making a SEPA Transfer of funds that will result in a credit of the relevant funds to your Account.

"Secondary Card" where applicable, any extra Card which is issued to a Customer or Authorised Person;

“SEPA Transfer” A facility available for UK registered Accounts only whereby you instruct us to send Euros to a bank account elsewhere in the Single Euro Payments Area (“SEPA”), quoting the IBAN of the intended recipient of the funds.

“Simplified Due

Diligence” means a lighter form of Customer Due Diligence, resulting in certain lower Card and Account limits

"Transaction" a Direct Debit, Payment, a Transfer or a SEPA Transfer;

“Transfer” a transfer of E-money from one Account to another Account.

“Virtual Card” a Card number issued by us for the purpose of making a single Payment without also issuing any corresponding physical card.

- Contact and Regulatory Information

- Your Card or Account can be managed online at www.abmoneyplus.com or by email to This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone to +44 (0) 203 355 9660. To report your Cards lost or stolen please call +44 (0) 203 355 9660 or email This email address is being protected from spambots. You need JavaScript enabled to view it.. At any time during the contractual relationship you shall have the right to receive, on request, these terms and conditions free of charge.

- The issuer for Your A&B Money Plus Prepaid Mastercard Cardand provider of the Payment Services is A&B Plus. A&B Plus is registeredin England and Walesunder Company Registration Number is 6928080. Registered Office: M228, Trident Business Centre, 89 Bickersteth Road, London SW17 9SH.

- A&B Plus is authorised and regulated as an e-money issuer by the Financial Conduct Authority registration number 6928080. Details of the A&B Plus authorisation licence by the Financial Conduct Authority is available on the public register at https://register.fca.org.uk/s/firm?id=001b000001HiyR6AAJ.

- A&B General Limited actsas the programme issuer.

- A&B Money Plus is the programme manager and is registered in the UK with registered office located at M228, Trident Business Centre, 89 Bickersteth Road, London SW17 9SH.

- Type of Service, Eligibility and Account Access

- Your Card is not a credit card and is not issued by a bank. Regardless of the type of Card(s) you have, you will have only one Account where your Available Balance is located.

- Your Payment Services may not be activated unless we have been provided with the required information so that we may identify you and can comply with all applicable Customer Due Diligencerequirements. We shall keep records of such information and documents in accordance with all applicable legal and regulatory requirements.

- Reference to a currency (e.g. Euros € or Sterling £) shall mean that amount or the local currency equivalent in which your Card is denominated.

- Any Transaction on your Card in a currency other than the currency in which your Card is denominated, will require a currency conversion using an Applicable Exchange Rate.

- The Available Balance on your Card and/or Account will not earn any interest.

- The Payment Services are prepaid payment services and not a credit or bank product, you must therefore ensure that you have a sufficient Available Balance from time to time to pay for your Transactions and applicable Fees. If for any reason a Transaction is processed, and the Transaction amount exceeds the Available Balance, you must repay us the amount of such excess immediately and we shall be entitled to stop any existing or subsequent Transactions from proceeding.

- This Agreement does not give you any rights against theCard Schemes, its affiliates or any third party.

- Only persons over 18 years of age are entitled to register for the Payment Services.

- Each time you seek access the Account we will asking for your Access Codes (as defined in Clause 8). As long as the correct Access Codes are entered, we will assume that you are the person giving instructions and making Transactions and you will be liable for them, except to the extent provided for in Clause 8. We can refuse to act on any instruction that we believe: (i) was unclear; (ii) was not given by you; or (iii) might cause us to breach a legal or other duty; or if we believe the Payment Service is being used for an illegal purpose.

- We will do all that we reasonably can to prevent unauthorised access to the Account. As long as you have not breached the other terms contained in this Clause 3 or Clause 8, we will accept liability for any loss or damage to you resulting directly from any unauthorised access to the Account pursuant to Clauses 14 and 15 of this Agreement.

- Service Limits, Direct Debits, Transfers & SEPA Transfer Payment (UK Only)

4.1 Transactions may be restricted by Card or Account type, individual usage patterns and payment risk profiles. Cards are issued in accordance with regulatory limits and conditions. Limits relating to the use of Cards can be found in the attached Fees & Limits Schedule and on our website at www.abmoneyplus.com. For anti-money laundering and anti-fraud reasons we reserve our rights to change particular payment restrictions (including from those published or included herein) without notice and to the extent required to meet our regulatory obligations.

4.2 Simplified Due Diligence may be restricted to domestic ATM access, along with reduced annual maximum load limits and capped annual withdrawal limits. These limits will be subject to Scheme and regulatory requirements.

4.3 You can make a Transfer to another Account by signing in to your Account and following the relevant instructions.

4.4 When sending funds to your Account with us, we recommend that your or other senders make a Transfer using your A&B Plus bank account.

4.5 We cannot be held liable for the payment process or fees associated with bank(s) and or intermediary bank(s) to process payments from you to us. Any fee(s) charged by third parties, not limited to receiving, processing or crediting a payment for you will be deducted by us before crediting the remaining balance to you.

4.6 You are responsible for checking and confirming payment details and fees before making a payment to us or to your Account.

4.7 Where enabled, you may be eligible to instruct other organisations to create regular Direct Debits from your Account. You will be responsible for ensuring that the correct details are provided in order for the Direct Debit to be created for you. You must ensure at all times that you have a sufficient Available Balance to allow for the funds to be debited from your Account. You are responsible for checking the terms and conditions that have been provided to you by the organisation receiving the Direct Debit payments.

4.8 You may incur a charge for unpaid Direct Debits if there are not enough Available Funds to pay an incoming Direct Debit request.

4.9 You accept responsibility for cancelling any Direct Debit on your Account with the originator directly. A&B Plus will be able to do this on your behalf, and cannot accept liability for any losses due to your failure to cancel any Direct Debit.

4.10 A&B Plus will credit payments received to your Account at least once a day and before the end of the Business Day. Amounts received after the cut off period will be processed the next Business Day and you will hold A&B Plus free and clear from any responsibility is this regard.

4.11 You may be asked to provide us with evidence of source of funds in order for us to meet our regulatory requirements, in which case you agree to provide that evidence promptly. You represent and warrant to us that the evidence you provide to us is up to date, complete and accurate.

4.12 Where so enabled you may change your PIN at selected ATMs subject to a Fee.

4.13 Where enabled, you may be eligible to instruct companies to create regular SEPA Transfers from your UK issued and registered Account. You will be responsible for ensuring that the correct details are provided in order for the SEPA Transfer to be created for you. You must ensure at all times that you have a sufficient balance on your Account to allow for the funds to be debited from your Account. You are responsible for checking the terms and conditions that have been provided to you by the SEPA Transfer originator. A&B Plus, reserve(s) the right to decline or terminate any SEPA Transfer instruction(s) that you have requested.

4.14 You may incur a charge for unpaid SEPA Transfers if there are not enough funds in your Account to pay an incoming SEPA Transfer request.

- Use of the Payment Services

- You may access your Account information by logging into your Account through our website. From here you will be able to view details on your Transactions, including dates, currencies, charges or exchange rates applied. This information is accessible at any time and can be

- stored and reproduced as necessary.

- You can use the Payment Services up to the amount of the Available Balance for Transactions.

- If the Available Balance is insufficient to pay for a Payment, some Merchants will not permit you to combine use of a Card or Account with other payment methods.

- The value of each Transaction and the amount of any Fees payable by you under this Agreement will be deducted from the Available Balance.

- Once a Transaction is authorised, the relevant payment order may not be withdrawn (or revoked) by you after the time it is received by us, except for Direct Debits, for which you may revoke the payment order up until the end of the Business Day before the day agreed for debiting the funds (see Clause 5.6). A Transaction will be deemed to have been received by us at the time you authorise the Transaction as follows:

- for Payments and ATM Transactions, at the time we receive the payment order for the Transaction from the merchant acquirer or ATM operator, and

- A payment order for a Transfer or SEPA Transfer is provided to and received by us at the time it is issued by you via the Account;

- A request for a Direct Debit is deemed to be received on the agreed day (if the agreed day is not a Business Day, the request shall be deemed to have been received on the following Business Day).

- Any Direct Debit will remain in effect until revoked by you at the latest by the end of the Business Day preceding the latest execution date for the relevant Direct Debit. You accept responsibility for cancelling any Direct Debit on your Account with the relevant organisation it was intended to pay. Neither we norA&B Money Plus will be able to do this on your behalf and cannot accept liability for any losses due to late or non-cancellation of Direct Debits.

- Where a revocation of an authorised payment is agreed between us and you, we may charge a Fee for revocation.

- We will ensure that the amount of a SEPA Transfer is credited to the payment service provider of the payee by end of the Business Day following the time of the receipt of your payment order. If the payment service provider of the Merchant is located outside the EEA, we will effect payment as soon as possible and in any event as required by applicable law.

- In order to protect you and us from fraud, Merchants mayseek electronic authorisation before processing any Payment. If a Merchant is unable to get an electronic authorisation, they may not be able to authorise yourPayment.

- We may refuse to authorise any use of the Payment Services which could breach these terms and conditions or if we have reasonable grounds for suspecting that you or a third party have committed or are planning to commit fraud or any other illegal or un-permitted use of the Payment Services.

- Your ability to use or access the Payment Services may occasionally be interrupted, for example if we need to carry out maintenance on our Systems. Please contact Customer Services via our website to notify us of any problems you are experiencing using your Card or Account and we will endeavour to resolve any problem.

- Where applicable, you may apply to us for up to 5SecondaryCards, for use by Additional Cardholders on your Account. Additional Cardholders, for whom you are legally responsible, must be 13 years of age or older. All other Additional Cardholders must be 18 years of age or older. It is your responsibility to authorise the Transactions incurred by each Additional Cardholder on the relevant Secondary Card and to ensure that the Additional Cardholder keeps to the provision of this Agreement. You are responsible for their use of the Secondary Card and for paying any amounts they add to your Account even if the Additional Cardholder does not keep to the provisions of this Agreement. We accept no responsibility or liability of any kind whatsoever for use of any SecondaryCard by any Additional Cardholder for Transactions not authorised by you. If you successfully register and request one, we will send you a Secondary Card in the name of the Additional Cardholder with a copy of this Agreement, for which we will charge you an Additional Card Fee. Upon receipt of the SecondaryCard, you may give the SecondaryCard to the Additional Cardholder for their use, subject to:

- you providing them with the copy of this Agreement (by using the Secondary Card the Additional Cardholder consents to the terms of this Agreement,which will then bind you and the Additional Cardholder in relation to the use of the Secondary Card);

- the SecondaryCard must onlybe used by that person;

- you continuing to hold the Account and the Card with which the Secondary Card is associated;

- you informing the Additional Cardholder that you have retained the Primary Card and that you are still able to use the Account;

- us obtaining such further information and documentation in order to enable us to comply with all applicable Customer Due Diligence anti-money laundering requirements in relation to the Additional Cardholder.

- You will remain responsible for the use of the Payment Services, and for any Fees and charges incurred by the Additional Cardholder(s), and you will continue to be regarded as the holder of any funds already or subsequently loaded on the Account. The use of a Card in relation to which an Additional Cardholder has been registered will be regarded as confirmation that you have provided the Additional Cardholder with this Agreement.

- You or any Additional Cardholder may us to remove that Additional Cardholder, and in that case you must cut the relevant Secondary Card in half.

- You agree that we may give information about your Account to each Additional Cardholders and restrict what Additional Cardholders can do in relation to your Account.

- Except as required by law, we shall not be responsible, and you will be solely responsible, for compiling and retaining your own copy of the data in your Account and your activities in connection with this Agreement. Upon the termination of this Agreement for any reason, we shall have no obligation to store, retain, report, or otherwise provide any copies of, or access to, the Transaction data or any records, documentation or other information in connection with any Transactions or the Account.

- You agree to only use the Payment Services for lawful purposes and to adhere at all times to all laws, rules and regulations applicable to the use of the Payment Services, including the terms of this Agreement.

- You may not use the Payment Services to receive or transfer any funds on behalf of any other natural person or legal entity.

- Access by Third Party Providers

- You may consent to regulated third party providers (PISPs or AISPs) accessing your Account online to make payments or obtain information about balances or Transactions on yourCard and/or Account.

- The PISPs and/or AISPs must be appropriately registered and authorised in accordance with PSD2. You should check with the regulatory authority of the relevant country before giving consent to the relevant PISP/AISP.

- Any consent you give to a third-party provider is an agreement between you and it, we will have no liability for any loss whatsoever, as a result of any such agreement.

- Before giving consent, you should satisfy yourself as to what degree of access you are consenting to, how it will be used and who it may be passed on to.

- You should make yourself aware of any rights to withdraw the consent of access from the third party provider and what process it has in place to remove access.

- To the extent permitted by law or regulation and subject to any right to refund you may have under this Agreement, between you and us, we are not responsible for any actions that the relevant third party takes in relation tosuspending or terminating your use of their service or for any resulting losses. We are also not responsible for, or a party to, any agreement that you enter into with any relevant third party. You should make sure that you read and comply with such agreement or other applicable policies and note that this Agreement will continue to apply between us including to any Payment Services and our Fees as stated continue to apply.

- Where appropriate, we may deny access to your Account,to any third party where we consider such access to be a risk of money laundering or terrorism financing, fraud or other criminal activity. Should we need to take these actions and where possible, we will give reasons for doing so unless restricted by law or for internal security reasons.

- Condition of Use at Certain Merchants

- In some circumstances we or Merchants may require you to have an Available Balance in excess of the Payment amount. For example, at restaurants you may be required to have 15% more on your Card than the value of the bill to allow for any gratuity or service charge added by the restaurant or you.

- In some circumstances Merchants may require verification that your Available Balance will cover the Payment amount and initiate a hold on your Available Balance in that amount, examples include rental cars. In the event a Merchant places a pre-authorisation on your Account, you will not have access to these funds until the Payment is completed or released by the Merchant which may take up to 30 days.

- If you use your Card at an automated fuelling station, subject to Merchant acceptance, your Card may need to be pre-authorised for a pre-determined amount in the relevant currency. If you do not use the whole pre-authorisation or do not have Available Balance to obtain a pre-authorisation, it is possible that the pre-authorised amount will be held for up to 30 days before becoming available to you again.

- Some Merchants may not accept payment using our Payment Services. It is your responsibility to check the policy with each Merchant. We accept no liability if a Merchant refuses to accept payment using our Payment Services.

- In relation to any dispute between the you and a Merchant, provided you are able to satisfy us that you have already made all efforts to resolve the dispute with the relevant Merchant, we will attempt to assist you so far as is reasonably practicable. We may charge you a chargeback processing fee as referenced in the Fees & Limits Schedule provided to you with this document, for any such assistance we may give you with any dispute. If there is an un-resolvable dispute with a Merchant in circumstances where the Card has been used for a Payment, you will be liable for the Payment and will have to resolve this directly with the relevant Merchant.

- Managing & Protecting Your Account

- You are responsible for the safekeeping of your username and password for your Account (“Access Codes”) and the personal identification number for your Card (“PIN”).

- Do not share your PIN with anyone. You must keep your PIN safe,and separate from your Card or any record of your Card number and not disclose it to anyone else. This includes:

- memorising your PIN as soon as you receive it, and destroying the post mail or other authorised communication used to transmit it to you;

- never writing your PIN on your Card or on anything you usually keep with your Card;

- keeping your PIN secret at all times, including by not using your PIN if anyone else is watching;

- not disclosing your PIN to any person.

- The user of the Card(s) must sign the signature strip on any Personalised Card immediately when received.

- If you forget your PIN, you can retrieve it using the PIN Reveal option on our website www.abmoneyplus.com.

- Do not share yourAccess Codes with anyone except an Authorised Person. If you disclose the Access Codes to any Authorised Person, you are responsible and liable for their access, use or misuse of the Account, their breach of the terms of this Agreement or disclosure of theAccess Codes.

- The Payment Services may only be used by you and each Additional Cardholder or Authorised Person.

- You must not give the Card to any other person or allow any other person to use the Payment Services except Authorised Persons or Additional Cardholders. You must keep the Card in a safe place.

- Failure to comply with Clauses8.2 and/or 8.5 may affect your ability to claim any losses under Clause 14 in the event that we can show that you have intentionally failed to keep the information safe or you have acted fraudulently, intentionally, with undue delay or with gross negligence. In all other circumstances your maximum liability shall be as set out below at Clause15.

- If you believe that someone else knows your Account or Card security details, you should contact us immediately in accordance with Clause 13.

- Once yourCard has expired (see Clause 11), or if it is found after you have reported it as lost or stolen, you must destroy your Card by cutting itin two, through the magnetic strip.

- Identity Verification

- If you enter into Transactions over the internet, some websites require you to enter your name and address. In such cases you should supply the most recent address which has been registered with us by you as the Account address. The Account address is also the address to which we will send any correspondence.

- You must notify us within 7 days of any change in the Account address or your other contact details. You can notify us by contacting Customer Services who may require you to confirm such notification in writing. You will be liable for any loss that directly results from any failure to notify us of such a change as a result of undue delay, your gross negligence or fraud. We will need to verify your new Account address and shall request the relevant proofs from you.

- We reserve the right at any time to satisfy ourselves as to your identity and home address (for example, by requesting relevant original documents) including for the purposes of preventing fraud and/or money laundering. In addition, at the time of your application or at any time in the future, in connection with your Account, you authorise us to perform electronic identity verification checks directly or using relevant third parties.

- Right to Cancel ("Cooling-Off')

You have a right to withdraw from this Agreement under the following conditions:

- where you purchased the Payment Services then you have a “Cooling Off” period of 14 days beginning on the date of the successful registration of your Account, to withdraw from this Agreement and cancel the Payment Services, without any penalty but subject to deduction of any reasonable costs incurred by us in the performance of any part of the provision of services before you cancel. You must contact us within this 14-day period and inform us that you wish to withdraw from this Agreement and you must not use the Payment Services. We will then cancel the Payment Services and reimburse the amount of Available Balance on the Account to you. However, we reserve the right to hold Available Balance for up to 30 business days from receipt of your instructions before returning the balance, to ensure that details of all Transactions have been received.

- After the Cooling Off period you may only terminate the Payment Services as described in Clause12.

- Expiry & Redemption

- Your Card has an expiry date printed on it (the “Expiry Date”). The Card (and any Secondary Card) and any A&B Plus IBAN linked to the Card will no longer be usable following the Expiry Date, and you must not use it after that time, but you will still be able to receive and send funds to and from the Account associated with the Card.

- If a Card expires before your Available Balance is exhausted, you can contact Customer Services to request a replacement Card, provided you do so 14 days before the Expiry Date printed on your Card and subject to payment of a Fee (where specified). We reserve the right to issue you with a replacement for an expired Card even if you have not requested one. If you have not requested a replacement Card, you will not be charged a Card Replacement Fee.

- If your A&B Plus IBANis linked to your Account, rather than linked to your Card, then it will not expire when the Card expires, but will be available to use as long as the Account is available for your use.

- Your funds are available for redemption by contacting us at any time before the end of the 6 years after the date on which this Agreement ends under Clause 12, after which time your Available Balance will no longer be redeemable to you and we are entitled to retain the corresponding funds. Where an Available Balance remains for more than one year after the date on which this Agreement ends under Clause 12, we are not required to safeguard the corresponding funds in our Customer Funds Account, but you can still request redemption for up to 6 years. We may deduct from the proceeds of redemption of any such Available Balance the amount of any Late Redemption Fee.

- Provided that your request for redemption is made less than 12 months following the date on which this Agreement ends under Clause 12, redemption will not incur any Late Redemption Fee. If you make a request for redemption more than 12 months after the date on which this Agreement ends under Clause 12an Account Closure Fee may be charged (where specified).

- We shall have the absolute right to set-off, transfer, or apply sums held in the Account(s) or Cards in or towards satisfaction of all or any liabilities and Fees owed to us that have not been paid or satisfied when due.

- We shall have the absolute right to close your Account and submit a chargeback claim for the relevant Transactions if your Account is in negative standing for more than 60 days. If our chargeback is successful, funds paid to your Account may only be used to credit your Card or Account, and your Account will remain closed.

- If your Account is inactive (including without limitation no access to the account or payment Transactions) for at least 2 consecutive years and has an Available Balance, we may (but we are not obliged to) notify you by sending an e-mail to your registered e-mail address and give you the option of keeping your Account open and maintaining or redeeming the Available Balance. If you do not respond to our notice within thirty (30) days, we will automatically close your Account and initiate a Transfer of your Available Balance to the last payment account notified by you to us (your “Nominated Bank Account”) or by cheque to your last known address.

- Termination or Suspension of Your Account and/or Processing of Transactions

- We will terminate this Agreement and your use of the Payment Services with prior notice of at least 1 months. Or we will terminate the agreement at anytime if we found any suspicious activity on your account i.e. money laundering or illegal activities included with our Prohibited Industries/business outside the risk appetite.

- Your use of your Cardand any A&B Plus IBAN linked to the Card ends on the Expiry Date in accordance with Clause 11.2.

- This Agreement and your use of the Payment Services will also end when your ability to initiate all Transactions ceases.

- We may terminate or suspend, for such period as may reasonably be required, your use of the Payment Services in whole or in part at any time or the processing of any Transaction(s) if:

- there is any fault or failure in the relevant data processing system(s);

- we reasonably believe that you have used or are likely to use the Payment Services, or allow them to be used, in breach of this Agreement or to commit an offence;

- any Available Balance may be at risk of fraud or misuse;

- we suspect that you have provided false or misleading information;

- we arerequired to do so by law, the police, a court or any relevant governmental or regulatory authority;

- required to fulfil our legal obligations in relation to the fight against money laundering and financing of terrorism;

- there is suspicion of unauthorised or fraudulent access to or use of your Account or that any of its security features have been compromised, including the unauthorised or fraudulent initiation of a Transaction;

- we have reasonable grounds to believe you are carrying out a prohibited or illegal activity;

- we are unable to verify your identity or any other information pertaining to you, your Account or a Transaction.

- If any Transactions are found to have been made using your Card or A&B Plus IBAN after expiry or any action has been taken by us under Clause12.4,you must immediately repay such amounts to us.

- Where it is practicable and lawful for us to do so or would not compromise reasonably justified security reasons, we will notify you via email of the suspension or restriction and the reasons for itbefore such measures take place or immediately thereafter.

- We will reinstate your Account or execute the relevant Transaction(s) as soon as practicable after the reasons pursuant to Clause 12.4 no longer apply or exist.

- If you wish to terminate the Payment Services at any time, you must request termination and the return of your Available Balanceby email to our address in Clause 2 from the email address registered in your Account. Our Customer Services department will then suspend all further use of your Payment Services.

- Once we have received all the necessary information from you (including any Customer Due Diligence) and all Transactions and applicable Fees and charges have been processed, we will refund to the you any Available Balance less any Fees and charges payable to us, provided that:

- you have not acted fraudulently or with gross negligence or in such a way as to give rise to reasonable suspicion of fraud or gross negligence; and

- we are not required to withhold your Available Balance by law or regulation, or at the request of the police, a court or any regulatory authority.

- Once the Payment Services have been terminated, it will be your responsibility to destroy the Card(s) that were provided to you.

- If, following reimbursement of your Available Balance, any further Transactions are found to have been made or charges or Fees incurred using the Card(s) or we receive a reversal of any prior funding Transaction, we will notify you of the amount and you must immediately repay to us such amount on demand as a debt.

- Loss or Theft of your Card or Misappropriation of Your Account

- If your Card is lost or stolen or if you think someone is using your Card, PIN and/or Access Codes without your permission or if your Card is damaged or malfunctions:

- you must contact us as soon as possible and you must provide us with your Account or Card number and either your Username and Password or some other identifying details acceptable to us so that we can be sure we are speaking to you; and

- Provided we have obtained your consent to close the Account, we will then provide you with a replacement Card with a corresponding new Account loaded with an amount equivalent to your last Available Balance.

- Once we have been notified of any loss or theft, we will suspend the Payment Services as soon as we are able, to limit any further losses (see Clause 14). We can only take steps to prevent unauthorised use of the Payment Services if you can provide us with the Account or Card number and Username and Password and if you can produce sufficient details to identify yourself and the relevant Account.

- Replacement Cards will be posted to the most recent Account address registered by you. Failure to provide the correct address will result in a Card Replacement Fee.

- If you subsequently find or retrieve a Card that you have reported lost or stolen, you must immediately destroy the found Card by cutting it in half through the magnetic stripe and chip.

- You agree to help us, our agents, regulatory authorities and the police if your Card is lost, stolen or if we suspect that the Payment Services are being misused.

- If your Card is lost or stolen or if you think someone is using your Card, PIN and/or Access Codes without your permission or if your Card is damaged or malfunctions:

- Liability for Unauthorised or Incorrectly Executed Transactions

- Subject to Clauses 14.2, 14.3 and 14.6 we will reimburse you in full for all unauthorised Transactions sent from your Account immediately and in any event no later than the end of the following Business Day after noting or being notified of the Transaction (except where we have reasonable grounds for suspecting fraud), provided that you have informed us of the unauthorised Transaction without undue delay after becoming aware of the Transaction and in any event, no later than 13 months after the Transaction was executed. Where applicable, we shall restore your Account to the state in which it would have been had the unauthorised Transaction not taken place, so that that the credit value date shall be no later than the date the amount had been debited.

- You may be liable for losses relating to any unauthorized Transactions up to a maximum of £35 resulting from the resulting from the use of a lost or stolen Card or the misappropriate of your Account, unless the loss, theft or misappropriation was not detectable to you prior to payment (except where you acted fraudulently) or was caused by acts or lack of action of our employee, agent, branch or service provider.

- You are liable for any losses incurred by an unauthorised Transaction if you have acted fraudulently or failed either intentionally or through gross negligence, to use your Account in accordance with the terms of this Agreement or to keep your Access Codes confidential and secure in accordance with Clause 8.

- You shall not be liable for losses incurred by an unauthorised Transaction which takes place after you have notified us of a compromise of your Access Codes according to Clause 8, unless you have acted fraudulently, or where we have failed to provide you with the means to notify us in the agreed manner without delay on you becoming aware of the loss, theft, misappropriation or unauthorised use of your Card or Account.

- We shall not liable for a refund or losses incurred by an incorrectly or non-executed payment Transaction if the details of the payee’s account provided by you were incorrect or we can prove that the full amount of the Transaction was duly received by the payment service provider of the payee.

- We shall not be liable for any unauthorised or incorrectly executed Transactions in case the Transaction was affected by abnormal and unforeseeable circumstances beyond our reasonable control or where we acted in accordance with a legal obligation.

- Where we are liable for the incorrect execution of a Transfer or SEPA Transfer that you receive under this Agreement, we shall immediately place the amount of the Transaction at your disposal in accordance and credit the corresponding amount to your Account no later than the date on which the amount would have been value dated, had the Transaction been correctly executed.

- Where we are liable for the incorrect execution of a Payment, Transfer or SEPA Transfer by you as payer, we shall, without undue delay, refund to you the amount of the non-executed or defective Transaction, and, where applicable, restore the debited Account to the state in which it would have been had the defective Transaction not taken place.

- In the case of a non-executed or defectively executed Payment, Transfer or SEPA Transfer by you as payer, we shall, regardless of whether we are liable, on request, make immediate efforts to trace the Transaction and notify you of the outcome, free of charge.

- A Paymentinitiated by or through a payee (e.g. a Merchant) shall be considered to be unauthorised if you have not given your consent for the Payment to be made. If you believe that a Payment has been made without your consent you should contact us in accordance with Clause 2.

- A claim for a refund of an authorised Direct Debit orPayment initiated by or through a payee (e.g. a Merchant) where the authorisation did not specify an exact amount of payment Transaction (and the amount of the Payment exceeded the amount that you reasonably could have expected taking into account your previous spending pattern, this Agreement and the circumstances of the case), must be made within 8 weeks from the date on which the funds were deducted from your Available Balance. Within 10 Business Days of receiving your claim for a refundor within 10 Business Days of receiving further information from you, we will either refund the full amount of the Paymentas at the date on which the amount of the Payment was debited or provide you with justification for refusing the refund.

- The right to a refund under this Clause 14 does not apply where you have given consent directly to us for the Payment to be made and, if applicable, information on the Payment was provided or made available to you by us or the payee in an agreed manner for at least four weeks before the due date.

- If you are not satisfied with the justification provided for refusing the refund or with the outcome of your claim for a refund, you may submit a complaint to us or contact the complaints authority as described in Clause 16.

- If at any time we have incorrectly deducted money from your Available Balance, we shall refund the amount to you. If we subsequently establish that the refunded amount had been correctly deducted, we may deduct it from your Available Balance and may charge you a Fee. If you do not have sufficient Available Balance, you must repay us the amount immediately on demand.

- Where any request, Transaction, disputed Transaction, arbitration or reversed Transaction involves third party costs, you remain liable for these and they will be deducted from your Account or otherwise charged to you.

- General Liability

- Without prejudice to Clause 14 and subject to Clause 15.4;

- neither party shall be liable to the other for indirect or consequential loss or damage (including without limitation loss of business, profits or revenues), incurred in connection with this Agreement, whether arising in contract, tort (including negligence), breach of statutory duty or otherwise;

- we shall not be liable:

- if you are unable to use the Card or Payment Services for any valid reason stated in this Agreement;

- for any fault or failure beyond our reasonable control relating to the use of the Payment Services, including but not limited to, a lack of Available Balance or fault in or failure of data processing systems;

- for any loss, fault or failure relating to the use of a Third-Party Provider as stated in Clause 6.3, 6.6 and 6.7 of this Agreement,

- if a Merchant refuses to accept a Payment or fails to cancel an authorisation or pre-authorisation;

- for the goods or services that are purchased with your Card;

- for any dispute you might have with a Merchant or other user of the Payment Servicewhere you acted with:

- undue delay

- fraudulently; or

- With gross negligence. (including where losses arise due toyour failure to keep us notified of your correct personal details)

- Without prejudice to Clause 14 and subject to Clause 15.4;

- You agree that you will not use the Payment Services in an illegal manner and you agree to indemnify us against any claim or proceeding brought about by such illegal use of the Payment Services by you, your Authorised Person(s) and Additional Cardholder(s).

- You are solely responsible for your interactions with Merchants or other users of the Payment Service. We reserve the right, but have no obligation, to monitor or mediate such disputes.

- To the fullest extent permitted by relevant law, and subject to Clause 14 and Clause 15.5, our total liability under or arising from this Agreement shall be limited as follows:

- where your Card is faulty due to our default, our liability shall be limited to replacement of the Card or, at our choice, repayment to you of the Available Balance; and

- in all other circumstances of our default, our liability will be limited to repayment of the amount of the Available Balance.

- Nothing in this Agreement shall exclude or limit either Party's liability in respect of death or personal injury arising from that party's negligence or fraudulent misrepresentation.

- No party shall be liable for, or be considered in breach of this Agreement on account of, any delay or failure to perform as required by this Agreement as a result of any causes or conditions which are beyond such Party's reasonable control.

- Dispute Resolution

- We are committed to providing an excellent customer experience for all our Customers. If we do not meet your expectations in any way, we want to have the opportunity to put things right.

- In the first instance, your initial communication will be with our Customer Services Team who can be contacted by Email to This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone to +44 (0) 203 355 9660. Our Customer Services Team will listen to your needs and will do their best to solve your issue promptly and fairly. We value the opportunity to review the way we do business and help us meet our customers’ expectations.

- If having received a response from our Customer Services Team you are unhappy with the outcome, please contact the Complaints Teamof A&B Genaral Ltd, 10 Greenwich Quay Clarence Road London SE8 3EY in writing via email on This email address is being protected from spambots. You need JavaScript enabled to view it.

- Once received, the Complaints Team will conduct an investigation and you will receive a response of itsfindings within 15 days of receipt of the complaint. In exceptional circumstances where we are unable to reply within the first 15 days, we will reply providing a reason for the delay and deadline for response, not more than 35 days after first receipt of complaint.

- If the Complaints Teamis unable to resolve your complaint and you wish to escalate your complaint further, please contact the Financial Ombudsman Service at South Key Plaza, 183 Marsh Wall, London, E14 9SR. Details of the service offered by the Financial Ombudsman Service are available at http://www.financialombudsman.org.uk/consumer/complaints.htm or alternatively you can lodge your complaint in your country of domicile with the Online Dispute Resolution process at https://ec.europa.eu/consumers/odr/main/index.cfm?event=main.home.show&lng=EN

- You must provide us with all receipts and information that are relevant to your claim.

- Your Personal Data

- A&B Plus is a registered Data Controller with the Information Commissioners Office in the UK under registration number Z1821175

- In order for us to provide you with the services relating to your Account, we are required to collect and process personal data about you, Additional Cardholders and Authorised Persons, with your consent or on alegal basis to meet our obligationsfor Anti-Money Laundering legislation or other governmental organisation. Where applicable, if an Account holder is under 16, then parental consent is explicitly required.

- Your consent will be sought for collection of your data and you have the right to agree or decline. Where you decline consent for the collection and processing of your data we reserve our right to discontinue service due to our obligations as a financial services institution.

- We may disclose or check your personal data with other organisations and obtain further information about you in order to verify your identity and comply with applicable money laundering and governmental regulations. A record of our enquiries will be left on your file.

- We may pass your personal data on to third-party service providers contracted to A&B Plus in the course of dealing with your Account. Any third parties that we may share your data with are obliged to keep your details secure, and to use them only to fulfil the service they provide you on our behalf. Where we transfer the personal data to a third country or international organisation, we ensure this is done securely and that they meet a minimum standard of data protection in their country.

- You have the right to receive information concerning the personal data we hold about you and to rectify such data where it is inaccurate or incomplete. You have the right to object to or withdraw any consent you have given for certain types of processing such as direct marketing.

- Your data will be retained for 6 years after the end of the provision of services to you, where your data will be destroyed in compliance with the requirements of the General Data Protection Regulation.

- In the event that you wish to make a complaint about how your personal data is being processed by us. you have the right to lodge a complaint directly with the supervisory authority and A&B Plus’s Data Protection Officer.

- OurPrivacy Policyprovides full details on your rights as a data subject and our obligations as a data controller. Please read this document carefully and ensure you understand your rights.

- Changes to the Terms and Conditions

We may update or amend these terms and conditions (including our Fees & Limits Schedule). Notice of any changes will be given on our website, or by e-mail notification, or by SMS at least at anytime. By continuing to use the Payment Services after the expiry of the 2-month notice period you acknowledge that you indicate your acceptance to be bound by the updated or amended terms and conditions. If you do not wish to be bound by them, you should stop using the Payment Services and terminate this Agreement in accordance with Clause 10 before the changes take effect.

- Miscellaneous

- We may assign or transfer our rights, interest or obligations under this Agreement to any third party (including by way of merger, consolidation or the acquisition of all or substantially all of our business and assets relating to the Agreement) upon 2 month’s written notice. This will not adversely affect your rights or obligations under this Agreement.

- Nothing in this Agreement is intended to confer a benefit on any person who is not a party to it, and no such person has any right under the Contracts (Rights of Third Parties) Act 1999 to enforce any terms of this Agreement, but this Clause do not affect a right or remedy of a third party which exists or is available apart from that Act.

- Any waiver or concession we may allow you, will not affect our strict rights and your obligations under this Agreement.

- This Agreement and the documents referred to in it, constitute the entire agreement and understanding of the parties and supersede any previous agreement between the parties relating to the subject matter of this Agreement.

- Funds Protection

All relevant funds corresponding to your Available Balance are segregated from our funds and held in the Customer Funds Account in accordance with the safeguarding requirements of the Electronic Money Regulations 2011 by law. In the event that we became insolvent those funds are protected against claims made by any of our creditors.

- Regulation & Law

- The Payment Services, Card and Account are payment services and not deposit, credit or banking products and are not covered by the Financial Services Compensation Scheme.

- This Agreement shall be governed byand interpreted in accordance with the laws of England & Wales, and any dispute or claim in relation to this Agreement shall be subject to the non-exclusive jurisdiction of the English courts. However, if you reside outside of England and Wales you may bring an action in your country of residence.

_______________________________________________

Fee and Limits Schedule

The following Fees apply:

| Account Opening | |

| KYB Compliance & Admin proceed for GBP account | £150.00 |

| KYB Compliance & Admin proceed for EUR account | £150.00 |

| KYB Compliance & Admin proceed for USD account | £150.00 |

| Risk Business i.e. Money remittance / Cryptocurrency | From £2,000 |

| Monthly Charge | |

| Monthly Service Charge on GBP account | £50.00 |

| Monthly Service Charge on EUR account | €65.00 |

| Monthly Service Charge on USD account | $75.00 |

| Compliance Monthly Charge (Financial& Risk Business) | £500.00 |

| Account Pricing | |

| Outgoing Bank Transfer (UK Local account) | £0.99 |

| Incoming Bank Transfer (UK Local account) | £0.79 |

| Outgoing Bank Transfer (EU SEPA) | €0.99 |

| Incoming Bank Transfer (EU SEPA) | €0.89 |

| Outgoing Bank Transfer (EU SEPA) - Urgent | €2.00 |

| Incoming Bank Transfer (EU SEPA) - Urgent | €1.00 |

| Incoming Bank Transfer USD | $20.00 |

| International Payment (SWIFT PAYMENT) | |

| Incoming in GBP via Swift international | £15.00 |

| Outgoing in GBP via Swift international | £25.00 |

| Incoming in EUR via Swift international | €20.00 |

| Outgoing in EUR via Swift international | €30.00 |

| Incoming in USD via Swift international | $20.00 |

| Outgoing in USD via Swift international - Not Available | N/A |

| Bank Services Fee | |

| Bank Swift Message (proof of payment for bank trace) | £15.00 |

| Changing Conversation date | £15.00 |

| FX Fee (Between the account) | |

| FX margins from 40 basis points (0.40%) depend on trade volume | From 0.40% |

| Cash Deposit to Account | |

| Cash deposit with A&B Money Branch | 1% |

| Withdraw Cash with A&B Money Branch | Free |

| Card Pricing | |

| Card Fee | £10.00 |

| Lost/ Stolen Replacement Card | £10.00 |

| ATM withdraw domestic up to £250 per time / 4 time a day | £3.00 |

| ATM withdrawal international | £10.00 |

| Debit/Credit Card deposit to account | Minimum £1 or base on volume GBP 0.50% / 1.00% |

| Instant bank transfer between A&B Money account | £2.00 |

| Manual debit/credit (By Bank Staff) | Free |

| ATM Balance Inquiry | £0.99 |

| ATM PIN change | £0.99 |

| POS domestic | £0.50 |

| POS international | GBP 1.00 plus 1.00% |

| POS/ATM Decline | £0.50 |

| PIN Reveal | £2.00 |

| FX Fee (between the currency on platform) | 3.00% |

| Cash Deposit to Account | |

| Cash deposit with A&B Money Branch | 1% |

| Withdraw Cash with A&B Money Branch | Free |

| Minimum Cash Deposit with Post Office / Pay Zone | £2.00 |

| Maximum Cash Deposit on transaction | £5,000.00 |

| Max Load Amount Per Day | £5,000.00 |

| Maximum Card Balance | £1,000,000.00 |

| Maximum POS daily spend | On Account Balance |

| Max number of deposits cash per day | 1.0 |

| Maximum ATM daily Withdrawal | £ 250/ 4 time a day |

Login Account

Block Card

In case of lost or stolen card.

You can lock the card to prevent fraud from other persons in 2 ways.

1. Lock your card manually in Online Account system.

To prevent theft or fraud from loss or stolen card, you can login Online Account 24/7 and lock the card by choose the Block Card.

2. Contact the staff directly.

You can immediately lock your card at +44 (0) 203 355 9660 (UK) or +49 (0) 800 724 3923 (Germany). Our staffs will cancel your old card and send a new card to your registered address. All account balance will be protected and transferred to the new card.

Top up

There are 4 ways to transfer money to your account

1.Bank Transfer

1.Bank Transfer

Bank Transfer (Domestic)

You can check your A&B Money Plus account numbers in GBP and EUR when you log in to Online Account.

You can then provide the Account number + Sort Code (GBP) or IBAN + BICS (EUR) account details to your employer to get a salary or give someone account number to transfer funds to your account.

Alternatively, you can transfer money from your other bank accounts to a new account in GBP in the UK or a new account in EUR in Europe.

Bank Transfer (overseas)

You can receive fund from abroad in the IBAN + Swift Code system, which will also be available in your Online Account.

You can give your parent in Thailand the bank details so that they can send you tuition fees or your overseas expenses easily.

2.Deposit via Card Transfer (A & B Money Plus Card only)

2.Deposit via Card Transfer (A & B Money Plus Card only)

Please contact A&B Money team if you need to transfer fund from another bank card to your card with us. Feel free to speak with our member team at +44 (0) 203 355 9660 between 9.00-17.00 (UK time) Monday-Saturday

3.Visit our office

3.Visit our office

You can visit our office in London at 2nd Floor, 10 Greenwich Quay Clarence Road London SE8 3EY, UK. Between 9.00-17.00 (UK time) Monday-Saturday.

We can help you on language barrier for deposit fund to your account i.e. card transfer via machine (POS)

4.Contact our staffs directly.

4.Contact our staffs directly.

If you want to pay in other currencies i.e. THB, USD, SEK and JPY etc.

If you need more information or need assistance from our staffs, please contact our staff directly at +44 (0) 203 355 9660 (UK) or +49 (0) 800 724 3923 (Germany).

Start using the card

Once you open an account with us, you will receive a Prepaid Mastercard which will be delivered to the registered address you have provided. You need to activate the card so that the card can be used effectively.

After the card is activated, you will receive a 4-digits password for the card pin via text message. This code is available to use at Cash Machine and for the street shop including online shopping around the world under the authority of MasterCard.

How to activate the card?

You can choose to activate your card in two ways:

1. Activate your card by yourself via Online Account.

Just login to Online Account from our website at www.abmoneyplus.com

Enter your registered username and password and click Activate your card by entering your 16 digits card number and other card details.

You can choose “Forgot username” or “Forgot password” to receive the new password if you cannot remember.

2. Contact the staff.

Contact our staff directly at +44 (0) 203 355 9660 (UK) or +49 (0) 800 724 3923 (Germany) for activating your card. You need to have card in hand so that you can provide the details on the card to our staffs.

อายัตบัตร

ในกรณีที่บัตรสูญหาย หรือถูกขโมย !

คุณสามารถสั่งล็อคบัตรเพื่ออายัตไม่ให้บุคคลอื่นนำบัตรของคุณไปใช้งานได้ โดยคุณสามารถเลือกสั่งล็อคบัตรได้ 2 รูปแบบ คือ

1. สั่งล็อคบัตรด้วยตนเองในระบบ Online Account

คุณสามารถ Login Online Account และสั่งล็อคบัตรในคำสั่ง Block Card ได้เองตลอด 24 ชั่ว 7 วันต่อสัปดาห์ เพื่อป้องการโจรกรรม หรือถูกนำไปใช้จากบุคคลอื่นในระหว่างที่การ์ดสูญหาย หรือถูกโจรกรรม

2. ติดต่อเจ้าหน้าที่โดยตรง

คุณสามารถแจ้งอาณัติบัตรได้ทันทีที่เบอร์ +44 (0) 203 355 9660 (UK) หรือ +49 (0) 800 724 3923 (Germany) เราจะทำการยกเลิกบัตรเก่าของคุณ และจัดส่งบัตรใหม่ไปที่อยู่ของคุณที่ลงทะเบียนไว้กับเรา ยอดเงินทั้งหมดในบัญชีจะถูกปกป้อง และรักษาสภาพเดิม 100% ไว้สำหรับบัตรใบใหม่ที่จัดส่งไปให้

เติมเงิน

คุณสามารถโอนเงินเข้าบัญชีของคุณได้หลากหลายถึง 4 วิธี ดังนี้

ฝากเงินเข้าบัญชีธนาคาร (Bank Transfer)

ฝากเงินเข้าบัญชีธนาคาร (Bank Transfer)

โอนเงินผ่านบัญชี (ในประเทศ)

คุณสามารถตรวจสอบเลขบัญชีธนาคาร A&B Money Plus ในสกุลเงิน GBP และ EUR ได้เอง เมื่อคุณ Login เข้าสู่ระบบ Online Account

หลังจากนั้นคุณสามารถแจ้งรายละเอียดบัญชีดังกล่าว Account + Sort Code (GBP) หรือ IBAN + BICS (EUR) ให้กับนายจ้าง เพื่อรับเงินเดือน หรือคู่ค้าเพื่อที่พวกเค้าจะสามารถโอนเงินเข้าบัญชีของคุณได้

หรือ คุณสามารถโอนเงินจากบัญชีธนาคารเดิมของคุณ เช่น Barclays Bank มายังบัญชีใหม่ได้ในสกุลเงิน GBP ใน UK หรือ จาก Deutsche Bank มายังบัญชีใหม่ได้ในสกุลเงิน EUR ในเยอรมัน เป็นต้น

โอนเงินผ่านบัญชี (ต่างประเทศ)

คุณสามารถรับเงินจากต่างประเทศได้ทั่วโลกในระบบ IBAN + Swift Code ซึ่งรายละเอียดบัญชีนั้นจะอยู่ใน Online Account ของคุณเช่นกัน

ซึ่งคุณสามารถเอารายละเอียดดังกล่าวส่งให้ผู้ปกครองในเมืองไทยเพื่อที่เค้าจะสามารถจัดส่งค่าเทอม หรือค่าใช้จ่ายในต่างประเทศของคุณได้

2.ฝากเงินผ่านระบบ Card Transfer (A&B Money Plus Card เท่านั้น)

2.ฝากเงินผ่านระบบ Card Transfer (A&B Money Plus Card เท่านั้น)

Login Online Account และเพื่อเข้าสู่คำสั่ง ‘Load money from other card’ แล้วจึงระบุรายละเอียดบัตรต้นทางที่ต้องการโอนเงิน และรายละเอียดบัตรของคุณที่จะรับเงิน พร้อมทั้งระบุจำนวนเงินที่จะทำรายการได้ตลอด 24 ชั่วโมง ซึ่งวิธีการโหลดเงินประเภทนี้จะได้รับปลายทางในทันทีภายใต้เงื่อนไขในระบบ A&B Money Plus ด้วยกันเท่านั้น

3.ฝากเงินสดเข้าบัญชีธนาคาร

3.ฝากเงินสดเข้าบัญชีธนาคาร

คุณสามารถนำบัตร และเงินสดที่ต้องการนำฝากเข้าบัญชีของตนเองไปยังสำนักงานของ A&B Money ที่ 2nd Floor, 10 Greenwich Quay Clarence Road London SE8 3EY, UK. ระหว่างเวลา 9.00-17.00 วันจันทร์-เสาร์

- เงินสดรับเงินปอนด์ขั้นต่ำ 100 ปอนด์

- เงินสดรับเงินยูโรขั้นต่ำ 10,000 ยูโร

- เงินสดรับเงินดอลล่าห์ขั้นต่ำ 10,000 ดอลล่าห์

4.ติดต่อเจ้าหน้าที่โดยตรง

4.ติดต่อเจ้าหน้าที่โดยตรง

หากคุณต้องการเลือกจ่ายเป็นเงินสกุลอื่น เช่น ไทยบาท (THB), โครเนอร์สวีเดน (SEK), ดอลล่าห์ (USD) เยนญี่ปุ่น (JPY) และอื่นๆ

หากคุณต้องการข้อมูลเพิ่มเติม หรือ ต้องการความช่วยเหลือจากเจ้าหน้าที่ของเราในการนำฝากเงินเข้าระบบ สามารถติดต่อเจ้าหน้าที่ของเราได้โดยตรงที่เบอร์ +44 (0) 203 355 9660 (UK) หรือ +49 (0) 800 724 3923 (Germany)

เริ่มการใช้งานบัตร

เมื่อคุณเปิดบัญชีธนาคารกับเราสำเร็จภายใต้เงื่อนไขมาตรฐานธนาคารสากล และ Mastercard คุณจะได้รับบัตร Debit Mastercard (Prepaid Card) ซึ่งจะถูกจัดส่งไปที่อยู่ที่คุณระบุมาจากการที่ขึ้นทะเบียนสมาชิก คุณจำเป็นต้องเปิดใช้งานบัตร (Activate Card) เพื่อที่บัตรจะสามารถนำไปใช้งานได้จริง

หลังจากบัตรถูกเปิดใช้งานแล้ว คุณจะได้รับรหัสลับเป็นเลข 4 ตัวของบัตรผ่านทาง text message (SMS) ซึ่งรหัสนี้มีไว้กดเงินจากตู้ Cash Machine (ATM) หรือ จับจ่ายตามร้านค้าตามท้องถนน รวมทั้งการช้อปออนไลน์ได้ทั่วโลกภายใต้อำนาจของ Mastercard

เปิดใช้งานบัตรได้อย่างไร?

คุณสามารถเลือกเปิดใช้งานบัตรได้ 2 วิธีคือ

- เปิดใช้งานบัตรด้วยตัวเองผ่านระบบ Online Account

เพียงแค่คุณ Login เข้าสู่ระบบ Online Account จากหน้าเวปไซค์ของเราที่ www.abmoneyplus.com

และกรอก username และ Password ที่คุณตั้งไว้ตอนขึ้นทะเบียนสมาชิก และเข้าไปกด Activate บัตรของคุณโดยกรอกเลข 16 ตัวหน้าบัตร และรายละเอียดอื่นๆ จากบัตรที่คุณได้รับ

คุณสามารถเลือก Forget username หรือ password เพื่อให้ระบบจัดส่งไปให้ใหม่หากจำ username และ password ไม่ได้

- ติดต่อเจ้าหน้าที่พนักงาน

ติดต่อเจ้าหน้าที่ของเราโดยตรงที่เบอร์ +44 (0) 203 355 9660 (UK) หรือ +49 (0) 800 724 3923 (Germany) เพื่อขอความช่วยเหลือในการเปิดใช้งานบัตร (คุณจำเป็นต้องได้รับบัตรที่เราจัดส่งไปที่บ้านคุณเสียก่อนเพื่อที่คุณจะสามารถแจ้งรายละเอียดบนหน้าบัตรให้เจ้าหน้าที่ของเราให้ความช่วยเหลือได้)

อัตราค่าบริการ

ตารางค่าธรรมเนียม

| ค่าธรรมเนียมการเปิดบัญชี | |

| ค่าธรรมเนียมการเปิดบัญชีสกุลเงิน GBP | FREE |

| ค่าธรรมเนียมการเปิดบัญชีสกุลเงิน EUR | FREE |

| ค่าธรรมเนียมการออกบัตร Debit Card | £10 |

| ค่ารักษาบัญชีรายเดือน | |

| ค่ารักษาบัญชีสกุลเงิน GBP รายเดือน | £9.99 |

| ค่ารักษาบัญชีสกุลเงิน EUR รายเดือน | €9.99 |

| ค่าธรรมเนียมการใช้บัญชี | |

| โอนออกสกุลเงิน GBP (ในประเทศอังกฤษ) | £0.99 |

| รับเงินสกุลเงิน GBP (ในประเทศอังกฤษ) | £0.79 |

| โอนออกสกุลเงิน EUR (ในยุโรป) | €0.99 |

| รับเงินสกุลเงิน EUR (ในยุโรป) | €0.89 |

| ค่าธรรมเนียมการใช้บัญชีระหว่างประเทศ (SWIFT PAYMENT) | |

| รับเงินสกุลเงิน GBP ระหว่างประเทศ | £15.00 |

| โอนออกสกุลเงิน GBP ระหว่างประเทศ | £25.00 |

| รับเงิน EURสกุลเงิน ระหว่างประเทศ | €20.00 |

| โอนออกสกุลเงิน EUR ระหว่างประเทศ | €35.00 |

| ค่าธรรมเนียมการใช้บัตร | |

| ค่าธรรมเนียมการออกบัตร Debit Card | £10.00 |

| บัตรใหม่ กรณีบัตรหาย/ถูกขโมย | £10.00 |

| ถอน ATM ในประเทศ £250 /ครั้ง (ถอนได้ 4 ครั้ง/วัน) | £3.00 |

| ถอน ATM ต่างประเทศ | £10.00 |

| เติมเงินผ่าน Debit/Credit Card (โดยเจ้าหน้าที่) | ขั้นต่ำ £1 หรือ 1% ของยอดเงิน |

| โอนเงินระหว่างบัญชี AB Plus (ระบบ Instant Transfer) | £0.50 หรือ € 0.50 |

| ทำรายการผ่าน Debit/Credit (By Bank Staff) | FREE |

| เช็คยอดเงินผ่านตู้ ATM | £0.99 |

| เปลี่ยน PIN ผ่านตู้ ATM | £0.99 |

| ใช้บัตรซื้อของใน UK | £0.50 |

| ใช้บัตรซื้อของนอก UK | GBP 1.00 plus 1.00% |

| POS/ATM ปฎิเสธ | £0.50 |

| PIN Reveal | £2.00 |

| แลกเปลี่ยนเงินตรา (ระหว่างบัญชีตนเอง) | 3.00% |

|

หมายเหตุ : Online Banking และ บัตรจะถูกล็อคอัตโนมัติหากระบบไม่สามารถเรียกเก็บค่าบริการรายเดือน จำนวน £9.99 ได้ |

เครือข่ายการให้บริการ

คุณสามารถเปิดบัญชีธนาคารกับเราได้โดยไม่มีเงื่อนไข หากคุณมีเอกสารพาสปอร์ต และเอกสารแหล่งที่อยู่อาศัยในประเทศเครือสหภาพยุโรปภายใต้กฏหมายการเงินนานาชาติ สำหรับวีซ่าท่องเที่ยวที่มาพำนักอยู่ในประเทศเครือสหภาพยุโรปชั่วคราวไม่สามารถเปิดบัญชีกับเราได้

การเปิดบัญชีธนาคารกับเรานั้นไม่อ้างอิงกับประวัติ Credit Score ใดๆ ซึ่งเหมาะกับวีซ่านักเรียนที่ไม่มีประวัติด้านการเงิน ซึ่งมีอุปสรรคในการขอเปิดบัญชีธนาคารทั่วไป ตลอดจนข้อจำกัดอื่นๆ ที่ธนาคารสั่งระงับ และขอปิดบัญชีธนาคารของคุณ ก็สามารถมาเปิดบัญชีกับเราได้แทน